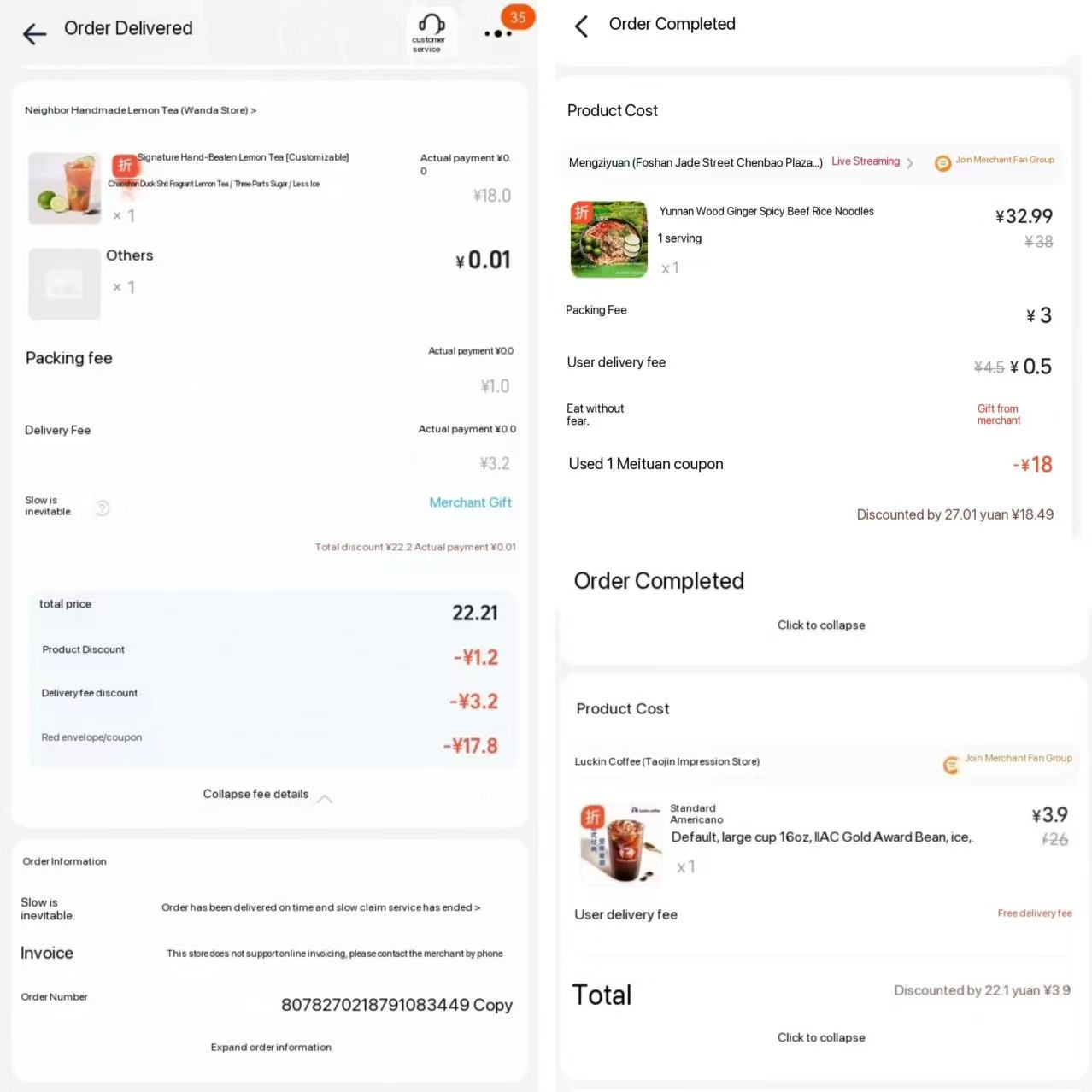

It all started with a cup of milk tea, billed at RMB2, delivered in under 30 minutes, and backed by billions in subsidies.

For months, China’s tech giants, Meituan, JD.com, and Ele.me, turned takeout waimai (food delivery service) into trench warfare, flooding apps with coupons that could slash your coffee or lunch bill by more than half.

Snapshots of Meituan Delivery Orders/provided to That's by Sunny

But as the summer heat peaked, so did the price war.

And when the Q2 financial reports dropped in late August, the drama reached its Season I finale: Meituan’s net profit plunged 89%, JD.com’s 50.8%, and Alibaba’s fell 18%.

Cheap lunches came at a steep cost.

So what now?

By late July, each platform started teasing its Season II—where the battlefield shifts from discounts to infrastructure, and the real question becomes: Who can build loyalty that lasts longer than a coupon code?

Image via 21jingji.com

Meituan: Scaling the Invisible Engine

Meituan is laying down the infrastructure for a new kind of food delivery economy.

By 2028, the company plans to open 1,200 Raccoon Cafeterias nationwide—delivery-only food courts equipped with standardized kitchen setups, livestreamed hygiene protocols, and full-chain traceability.

These hubs are designed to host up to 10 merchants per site, streamlining operations while keeping brands independent.

Backed by a RMB100 billion, three-year investment in their entire food and beverage sector (including food delivery logistic system, Raccoon Cafeterias and more), Meituan is betting that transparency and operational trust will become the new currency of consumer loyalty.

The goal: scale without cracking.

JD.com: Engineering Loyalty

JD is taking a different route, building a branded dining ecosystem from the ground up.

Its 7Fresh Kitchen initiative aims to open 10,000 outlets across China, each built around licensed recipes from culinary partners.

JD handles the location, staffing, and supply chain, while chefs bring signature dishes that are standardized and scaled.

The company has earmarked RMB1 billion for the rollout, positioning 7Fresh Kitchen as a long-term loyalty engine rather than a short-term subsidy play.

Analysts estimate JD’s food delivery arm now handles 20 million orders per day, but its Q2 losses in new business hit RMB14.8 billion, underscoring the urgency to convert volume into margin.

Alibaba: Stitching the Ecosystem

Alibaba is playing a quieter, more integrative game.

By merging Ele.me and Fliggy into its China eCommerce Business Group, it’s building a cross-channel consumption loop that connects travel, shopping, and dining.

Alibaba hasn’t disclosed a shop-count target or revenue forecast for this integration, but its broader ambition is clear: use AI to personalize the entire consumption journey—from booking a weekend getaway to ordering snacks for the train.

The infrastructure may be less visible, but the intent is no less expansive.

So What’s Next?

As subsidies drain fast, platforms are racing to build revenue streams that don’t rely on discounts.

For consumers, this means the RMB18 lunch might stick around a little longer, but the real shift is in how platforms define quality, trust, and experience.

Will Raccoon Cafeterias scale sustainably?

Will JD’s recipe licensing model buckle under copyright strain?

Will Alibaba’s algorithmic ambition stretch too far, trying to sync Fliggy, Taobao, and Ele.me?

Whatever happens, one thing’s clear: the waimai war may have cooled, but the race to redefine urban appetite is just heating up.

What Do You Think?

Drop us a line—we’d love to hear how the waimai war is playing out on your plate.

And you are more than welcome to join our poll:

Which platform do you trust most for your next meal?

A. Meituan

B. JD.com

C. Ele.me

D. I just follow the discounts

READ MORE: Ghost Kitchens on the Rise: Meituan & JD.com’s Delivery War

[Cover image via Tencent Finance]

0 User Comments