Thomas Greb, a Shanghai-based portfolio manager at Olivar & Greb Capital Management, has extensive experience in professional investment and wealth management consulting for individuals and families. When time permits, he shares his insight in this column for That’s to highlight key sectors, market movements, or trade ideas to consider for your portfolio.

Thomas Greb, a Shanghai-based portfolio manager at Olivar & Greb Capital Management, has extensive experience in professional investment and wealth management consulting for individuals and families. When time permits, he shares his insight in this column for That’s to highlight key sectors, market movements, or trade ideas to consider for your portfolio.

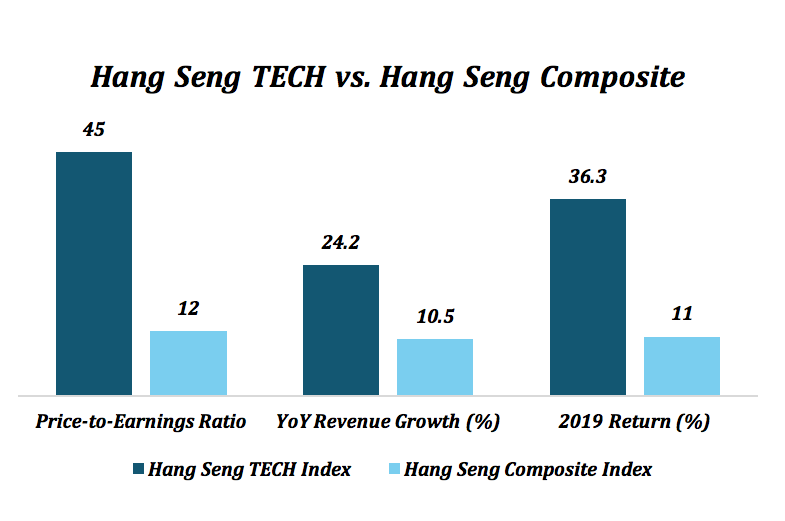

The Hang Seng index has previously been a poor indication of the Hong Kong stock market, mainly due to its underallocation of tech. This changed in late July, with the addition of the Hang Seng Tech index. The index is comprised of the 30 largest Hong Kong listed technology companies. With this new addition, here are the facts we think are most important for you to understand before investing in the new index.

Overview

Tracking the 30 largest tech companies listed in Hong Kong, the Hang Seng Tech Index had its debut on July 27. The categorical stock selection covers the industries of technology, internet, fintech, cloud, e-commerce and digital business. This comes during a time when both domestic and US listed Chinese tech giants are seeing unmatched returns as they continue to recover and benefit from the COVID-19 crisis. Additionally, according to back-tested data, the index would have attained returns of 36.2% for the full year of 2019 and 35.3% for the first half of 2020. For investors looking towards the tech sector, this new index is particularly attractive when compared to the main Hang Seng Composite so far in 2020.

The Deputy Chief Executive Officer of Hang Seng Indexes had this to say about it, and we think he hit the nail right on the head:

“In view of the rapid blossoming of new businesses in the technology sector and the increasing number of technology companies that are listed in Hong Kong, we developed the Hang Seng TECH Index to meet the fast-growing interest in this investment theme among investors. The Index aims to reflect the performance of sizeable companies in this sector, and to facilitate the development of various index-linked products, including funds and derivatives. We believe that this new index could join the Hang Seng Index and the Hang Seng China Enterprises Index to become one of our flagship indexes.”

What are its top holdings?

Top holdings provide key insights into a portfolio’s approach and the types of securities it invests in. Its top five holdings make up 40% of the index, which is standard among indexes as of late. As a comparison, the Dow Jones top five holdings encompases 40% as well. This reiterates how important a role these companies play. For Hang Seng Tech, the five top holdings are Alibaba, Tencent, Meituan, Xiaomi and Sunny Optical.

The top four are some of the biggest names in China and need little explanation as to why they deserve the position they currently hold. While Sunny Optical has been a little less fortunate this year, it is still viewed as a key index player.

Sunny is a leading optical device manufacturer and optical imaging system solution provider. With 5G networks forecasted by some to carry 45% of global mobile traffic by 2025, 5G will make it possible to upload and download 4K video on-the-go and eventually even 8K videos. Because of this, the need for new camera tech is expected to rise, allowing Sunny to directly benefit.

How to invest in the index

The first fund to track the index is the CSOP Hang Seng TECH Index ETF (3033.HK). Some of the brokerages that offer access to the fund are Interactive Brokers, TD Ameritrade and Swissquote. Other major Chinese tech funds worth noting are KraneShares CSI China Internet ETF (KWEB) and Invesco China Technology ETF (CQQQ).

Conclusion

For the first time, Chinese mainland investors will have access to companies like Alibaba (BABA), JD.com (JD), and Netease (NTES). Those companies may see increased money flows as they were previously unavailable to the mainland. Not only does the index stand to benefit from the performance of the major tech giants but also vice versa.

The Stock Connect Southbound channel allows Chinese mainland investors to access Hong Kong listed stocks, yet Alibaba, JD.com and Netease aren’t included in this because their primary listings are in the United States. Morgan Stanley pointed out that mainland investors would now be able to invest in funds that track the new tech index.

The lack of international talent in China could prove to be a long-term obstacle for the tech industry as they attempt to gain an edge on other, more globalized tech companies. However, the index should be seen with confidence. For a deeper analysis, investors can find more insight in Hang Seng’s press release.

Special thanks to Sam Hovey for fact finding and due diligence in this report.

To learn more about the index or how to invest, please reach out to Thomas Greb at thomas.greb@olivar-greb.com.

For more finance and investment articles, click here.

[Cover image via Ruslan Bardash/Unsplash]

0 User Comments