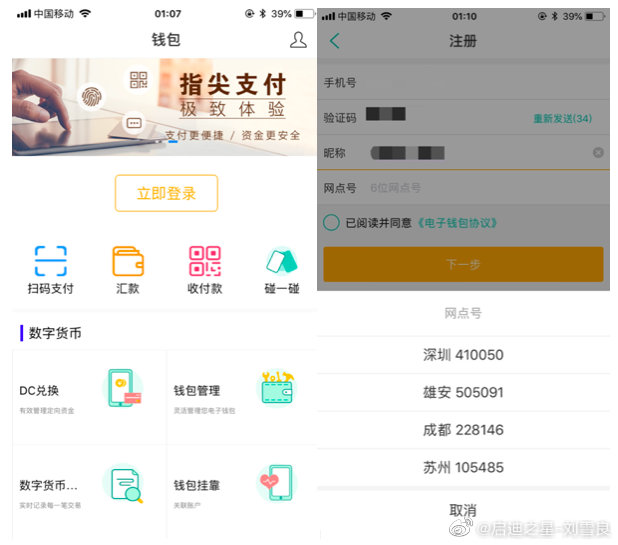

On the evening of April 14, screenshots of a beta app showing an e-wallet for China’s new government-backed digital currency were leaked online, effectively setting off a frenzy of speculation both in China and abroad about the future of currency.

It seems only fitting for China to be one of the first countries to launch their own digital currency. After all, they lead the world in digital transactions, accounting for 44% of the global digital payments total transaction value, according to Statista. China’s ‘cashless’ revolution has been well-documented over the past five years, and a new digital currency is another step in the inevitable paper currency phase-out.

But aside from advancing the transition from physical to digital wallets, what else will this currency provide and what might it accomplish in the decades to come?

E-RMB

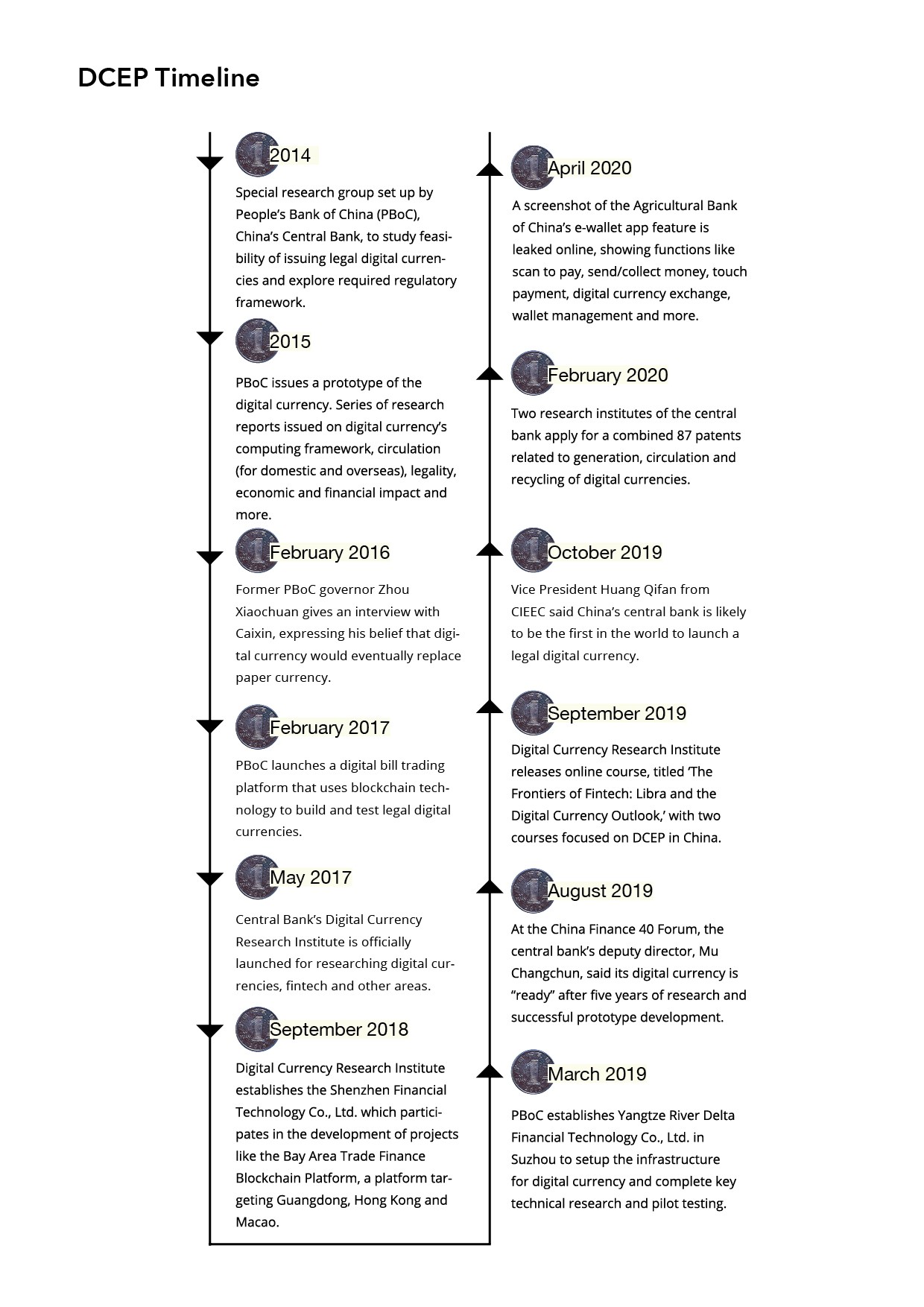

Since 2014, the People’s Bank of China (PBoC), the nation’s central bank, has pioneered the research behind this new digital tender, and in January 2017, established the Digital Currency Research Institute (DCRI) in Shenzhen to turn these plans into reality.

Essentially an electronic version of the renminbi, China’s Digital Currency Electronic Payment (DCEP) will be used in much the same way we handle banknotes – making payments, withdrawals and deposits – except that these functions will be performed using a digital wallet app. One of its primary functions is said to be the replacement of MO (money supply).

DCEP is being tested in four Chinese cities – Suzhou, Shenzhen, Chengdu and Xiong’an – in the early trial period. Although no official date for a nationwide rollout has been announced, there is speculation that it could be soon.

The move to digital cash makes sense on multiple levels, with commonly cited benefits including reduced costs related to issuing and circulating paper money as well as more ‘hygienic transactions.’ (The PBoC disposed of old banknotes at the start of the pandemic to curb the spread of the coronavirus.)

DCEP has several key differences from popular cryptocurrencies like bitcoin and ethereum. For starters, it’s a centralized legal tender created and sanctioned by the Chinese government, so China will have full control over the currency’s circulation, and therefore it cannot be mined like other cryptocurrencies. It will be powered by blockchain technology, however the PBoC will have access to currency movement and transaction data. The digital yuan is expected to help prevent illegal activities such as money laundering, counterfeiting, illegal financing and tax evasion.

Screenshots of China’s digital currency wallet. Image via @启迪之星-刘雪良/Weibo

Screenshots of China’s digital currency wallet. Image via @启迪之星-刘雪良/Weibo

DCEP will be available for transactions offline, and won’t require a bank account to access funds – benefiting the roughly 20% of adults in China without a bank account, according to 2018 data from the World Bank. In addition, it must be accepted by merchants who take digital payments from other third-party platforms, or risk losing their business license.

The digital currency is also expected to have a big impact on monetary policy. At the China Finance 40 Forum in October 2019, Huang Qifan, vice president of the China International Economic Exchange Center, said that DCEP “can achieve real-time collection of data related to money creation, bookkeeping, etc., providing useful reference for the provision of money and the implementation of monetary policies.”

Rising Competition?

In addition to digital currency testing via the four big Chinese banks, Alipay and WeChat Pay are also expected to distribute the currency in the future. On Chinese media, some have speculated what type of impact DCEP will have on the mobile payment duopoly, which accounted for 94% of Chinese mobile payments in the third quarter of 2019, according to data from iResearch. Despite DCEP having glaring differences from the mobile payment providers, the digital wallet screenshots posted in April show a scan-to-pay feature much like we currently use with Alipay and WeChat Pay.

Alipay’s face payment scanner at a 7-Eleven in Guangzhou. Image by Ryan Gandolfo/That’s

Peng Wensheng, chief economist with Everbright Securities, believes the new currency may compete with existing e-payment tools once DCEP is fully launched. “If businesses do not need to pay any fee for using the digital currency, it will take some of the market share of Alipay and WeChat Pay. In the future, digital money issued by the central bank is likely to compete and compliment the private sector’s electronic payment platforms,” said Peng, as cited by state-run newspaper China Daily. Others view this incoming age of digital currencies as another shake-up for payment firms. “The payment industry is an ancient industry. Merchants have always needed payment service providers, and the transformation of third-party payments has been a focus in recent years. The introduction of more value-added services and the transformation of merchants’ digital operations are new opportunities in this industry,” mobile payment industry analyst Mu Chu told Time Finance in early May.

However, once DCEP is officially launched, it will still take time to see how the digital currency integrates with current payment systems. During its pilot program, the digital yuan is being used to pay half of government workers’ travel subsidies. Foreign consumer brands like Starbucks and McDonald’s, as well as Ant Financial, Tencent and local restaurants and retail stores, are reportedly participating in some capacity during the testing phase.

A Modern World Currency

Industry experts have speculated that China’s digital currency development really ramped up after Facebook announced plans for its own digital currency, Libra, in June 2019. China Daily reported in September of last year that “Libra’s designing scheme might have sparked new ideas among Chinese financial regulators.”

Li Lihui, a former Bank of China president who is now involved with blockchain research at the National Internet Finance Association of China, held a webinar in early May titled ‘Digital Currency: Possible Restructuring of the Global Monetary System’ (数字货币: 可能重构全球货币体系), discussing the developments of both digital currencies. During the talk, Li expressed that Libra has likely made a lot of progress since its White Paper was released last year. “If Libra was just a draft in 2019, now it probably looks more like a legitimate blueprint,” Li said, also noting it has the “potential to fundamentally restructure the global monetary system.”

But what about DCEP? Similar to how finance and blockchain experts like Li have expressed the possibility Libra might disrupt the monetary system, others have pointed out the potential impact that digital yuan can make.

According to Boxmining editor Michael Gu, “the issuance of DCEP is conducive to promoting the internationalization of the RMB and reshaping the current cross-border payment system.” Currently, the US has a stronghold on cross-border payment and banking systems, with CHIPS (Clearing House Interbank Payments System) being a US company and internationally backed SWIFT (Society for Worldwide Interbank Financial Telecommunication) previously caught sending data to the US. During the Bund Financial Summit in Shanghai last year, Huang Qifan echoed similar sentiments, saying, “Prior to the launch of the RMB Cross-Border Payment System (CIPS), RMB cross-border liquidation was highly dependent on the US SWIFT system and CHIPS. However, there are certain risks associated with a high degree of reliance on SWIFT and CHIPS systems,” including outdated and inefficient infrastructure.

But so far, China’s intentions with DCEP have not been made entirely clear. One of the few takeaways from reports in state media is that China’s digital yuan will “showcase to the rest of the world what a genuine digital currency looks like.” The world has now been put on notice.

[Cover image via Pixabay]

0 User Comments