If you’ve noticed your Temu cart looking a little emptier lately, it’s not just your imagination.

As of May 2, the United States has officially closed the so-called 'de minimis' loophole, a rule that once allowed small packages—those under USD800 in value—to enter the country duty-free.

And now, Chinese e-commerce giants like Temu, Shein, and AliExpress are facing a major shake-up.

For years, this trade rule quietly powered a booming business model: cheap, direct-from-China goods arriving quickly and without extra charges for American consumers.

Temu, for instance, built much of its success on this framework, offering shockingly low prices by bypassing traditional import costs.

But with the de minimis rule gone and tariffs now reaching as high as 145%, things have changed fast.

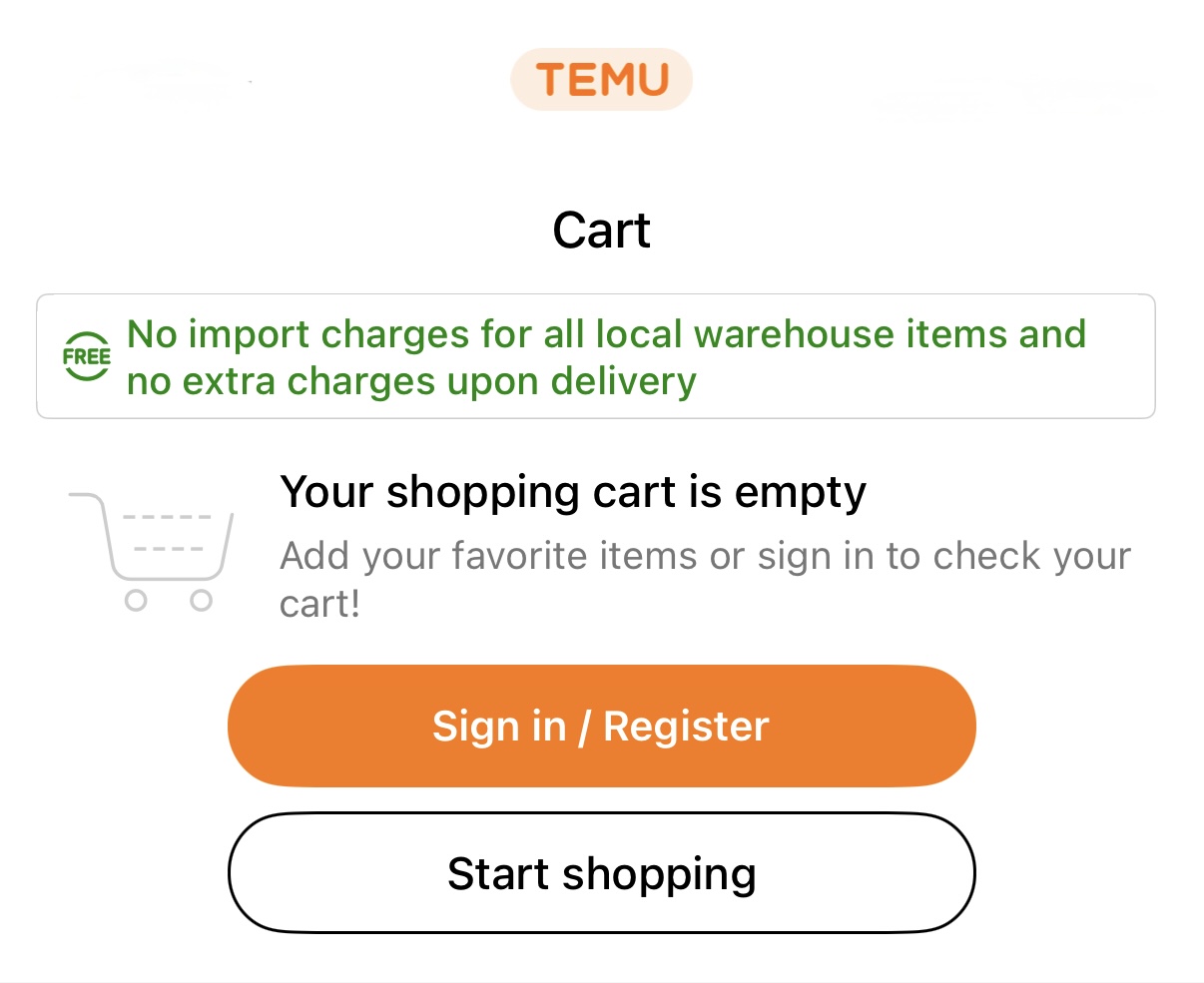

Temu has responded by removing listings of Chinese-sourced items from its US-facing site, replacing them with products stocked and shipped by local sellers in the US.

Shein has also adjusted pricing and logistics strategies in response to the new policy.

What Does This Mean for Chinese Small Exporters?

While headlines focus on American consumers, thousands of small- and mid-sized exporters across China are now grappling with far greater uncertainty.

For many of these businesses, Temu and AliExpress offered a rare direct pipeline to overseas buyers—no need for large-scale distribution channels or overseas warehouses.

By tapping into the de minimis exemption, even tiny workshops in Yiwu or Guangzhou could access US consumers with little overhead.

Now, with higher costs, stricter customs scrutiny, and logistical shake-ups, those margins may disappear altogether.

Temu’s new US-based model. Screenshot by That's

Temu’s new US-based model. Screenshot by That's

Some sellers may attempt to pivot toward Temu’s new US-based model, but that requires partnerships with domestic warehouses, inventory forecasting, and navigating foreign tax codes—hurdles that are often out of reach for micro-enterprises.

For exporters reliant on low-cost, high-volume goods, the US market may simply no longer be viable under the new conditions.

Instead, many are eyeing markets in Southeast Asia, Latin America, and even the Middle East, where demand is growing and trade barriers are (for now) less hostile.

That said, the transition won’t be easy, and many Chinese factories and merchants may see their overseas revenue dip, especially if they fail to adapt quickly.

What About American Shoppers?

Short term, expect fewer ultra-cheap options, longer delivery times, and new 'tariff surcharges' at checkout on platforms that still import from abroad.

Longer term, some analysts suggest certain retailers might scale back or even pull out of the US market, especially if the cost of doing business outweighs the profits.

It’s not just e-commerce platforms feeling the pressure.

Brick-and-mortar retailers across the US—especially those reliant on Chinese manufacturing—are reportedly scrambling to adjust.

They may have stockpiles for now, but concerns are mounting over the upcoming holiday season, when toys, ornaments, and electronics see peak demand.

Meanwhile, US ports are already reporting reduced container traffic, suggesting early signs of disruption across the supply chain.

Back in China, the policy shift is also sparking reflection.

With companies like PDD Holdings (拼多多, Temu’s parent company) holding strong positions in domestic markets, some experts believe a strategic pivot toward Asia, Europe, or Latin America may follow if US conditions worsen.

In the big picture, this marks another flashpoint in the ongoing US-China trade tensions, with ripple effects likely to continue through the year.

And for expats in China keeping an eye on global commerce or wondering why their go-to e-shop suddenly has fewer listings, this is one shift worth watching closely.

As we head into a new era of tariffs, warehouse strategies, and policy pivots, the question remains:

Will global trade reinvent itself again?

Follow our WeChat official account ThatsGBA for the latest international trade development in China and beyond.

[Cover image via @USPS/X]

0 User Comments