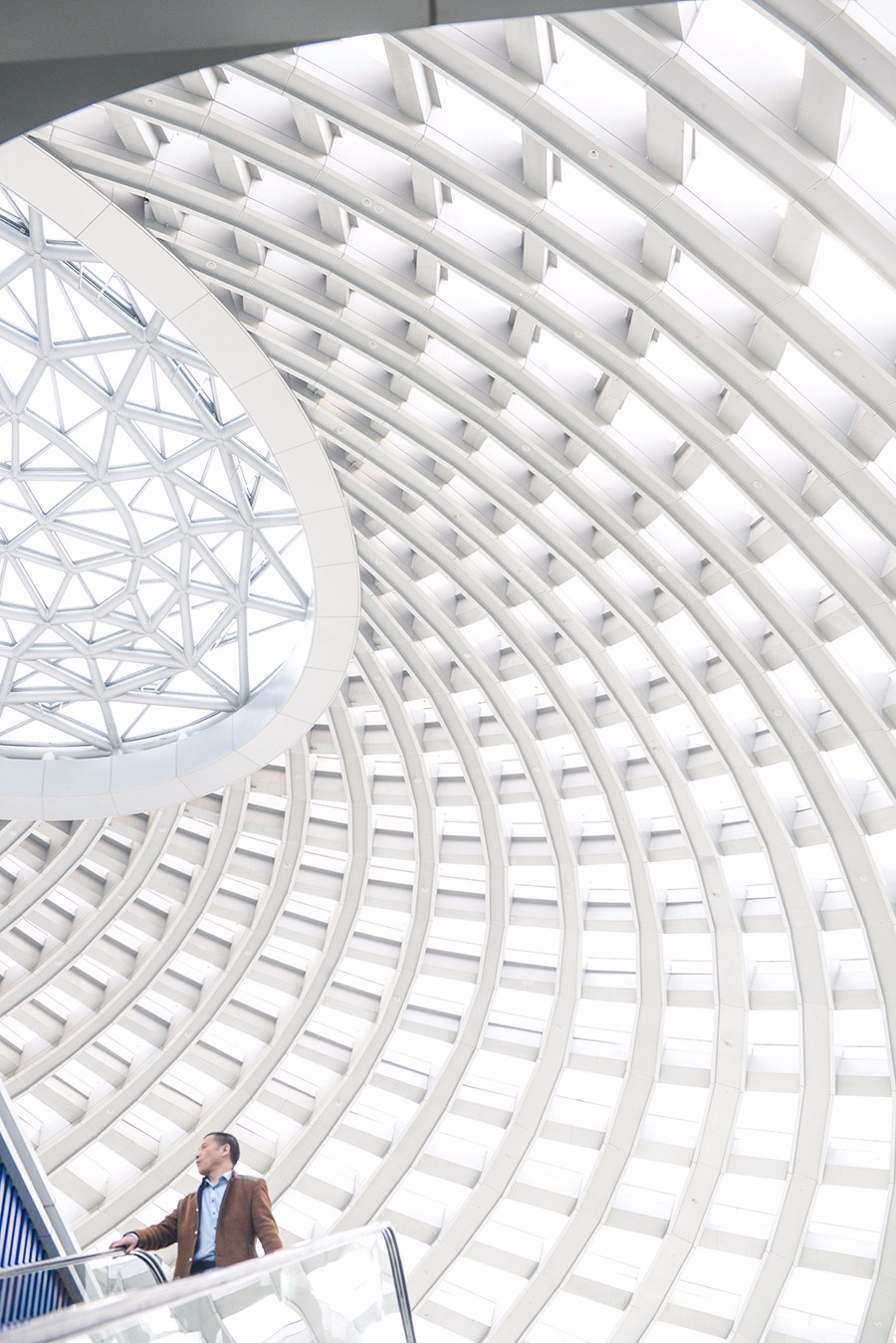

The domed silver facade of Yujiapu's railway station protrudes onto the landscape like a shimmering seashell lodged in the earth. Sunlight pours through its roof into a modern, airy interior of geometric patterns and concentric spirals made from metal and glass. Opened last year, and soon to be connected to Tianjin's subway system, the station offers a grand and spotlessly clean vision of this new financial district's future.

Inside Yujiapu's new high-speed rail station.

Since September, seven trains have arrived here daily from Beijing. Our morning service, while not completely full, is certainly busy, and return tickets have already sold out. Upon arrival, passengers stream out above ground where a line of taxis awaits their custom.

Just beyond lies one of China's most ambitious new urban development projects. Set across an area of 3.86 million square meters, Yujiapu is being billed as a future center of global finance. Its CBD, which is modeled loosely on Manhattan, will comprise around 100 new buildings. Urban planners hope that investment in the region of RMB200 billion can transform this former marshy fishing village into a vital hub for northeast China.

Yet, if media reports are to be believed, this is one of China's infamous 'ghost' cities. Yujiapu has been dogged by stories of its impending failure since the district's first building was completed in 2010. The world's news outlets – most of which visited long before the railway station had even opened – depicted a deserted, unfinished new city.

'China's replica Manhattan is a half-built and abandoned ghost town amid economic woes,' screamed one headline. 'Manhattan look-a-like turned into a "ghost city"' CNN reported.

Given that there are currently no schools, hospitals or public services in Yujiapu, it's hardly surprising that people haven't yet flooded in. But it was an easy story to tell. The unfinished buildings fed into a narrative of China's construction boom; images of wide, empty streets encapsulated an economic slowdown; and the comparisons with Manhattan added an element of 'weird' (another seemingly vital component of reporting on China).

But beneath the surface – literally – Yujiapu is starting to show signs of life. An underground free-trade zone, opened at the end of last year to attract businesses to the area, now offers duty-free shopping. It's quiet on our first midweek visit, but returning on a Sunday we discover an altogether different scene.

"We live nearby in Tanggu," explains a mother by the entrance to the shopping area. "We just came here to show our daughter around and to have a look at the shops."

A family on a weekend visit to Yujiapu's new free-trade zone.

They are not alone. Inside, young families and groups of teens browse cut-price import goods which are divided by country. Offerings range from Korean cosmetics and Turkish rugs to minimalist Danish furniture. Store employees tell us that although foot traffic has fallen since the opening buzz died down, business has been steady.

Officials expect much more. In a July 2015 interview quoted by Bloomberg (one of the few media outlets to offer in-depth coverage of the project beyond initial sensationalism), the Executive Deputy Director-General of the free-trade zone, Jiang Guangjian, claimed that Yujiapu's economic output was set to quadruple between 2015 and 2017.

Yet back above ground, it's easy to see how the ghost city tag emerged. While some cars and trucks trundle past, the main CBD area is still unnervingly quiet. Flower beds have been prematurely planted; there are few people here to enjoy them.

Yujiapu's neatly maintained plazas remain largely empty for now.

Like anywhere else in China undergoing rapid development, construction sites are fenced off by boards offering bold dreams in questionable English. 'Diversified commercial facilities with global exquisites' reads one, while another promises 'high-end office buildings gathering wealth and power.'

But for now, the area is populated largely by migrant workers. They can be found throughout the district's main arteries, painting trees, hammering in paving stones and pouring cement into wheelbarrows. Others rest on grassy banks or sit on the ground chatting and smoking cigarettes. The occasional crashes and clangs of construction echo between buildings in various stages of completion while, above us, figures can be seen between concrete beams.

The frame of (what will become) one of Yujiapu's tallest buildings.

A construction worker rests beside recently completed buildings.

A group of migrant workers take a break from their underground project building the new CBD's heating systems.

Neither these empty streets nor the busier free-trade zone tell the full story of Yujiapu. The new signs of life are no more an indication of the project's success than the lack of activity was an indication of its failure. The fact of the matter remains: It's simply too soon to judge.

"What many reporters did was go out and take a snapshot of a construction site then call it a ghost city," explains Wade Shepard, author of Ghost Cities of China. "But Yujiapu, like most of China's new cities, is a long-term project. These places are being built on 22- or 23-year timelines. They didn't start building the place until 2009 – it's still a very, very new development."

Fascination with Yujiapu was undoubtedly stoked by the parallels with Manhattan. They made the project ripe for mockery, though the comparison may have more to do with marketing than reality (one housing development's brochure depicts a replica of London's Tower Bridge, when the actual bridge here – wide and flat – bears no resemblance whatsoever). Yujiapu doesn't feel especially like it's trying to be New York – or no more so than other planned cities. Its wide boulevards and gridded streets lean toward an aesthetic favored by many new urban areas, from Brasilia to Islamabad.

Having said that, plans in the area do include a building based on the Rockefeller Center – as well as the district's very own twin towers. But before writing them off as cheap knock-offs, it's worth nothing that subsidiaries of the Rockefeller Group and Tishman Speyer (the real estate firm behind the original and new World Trade Centers) are both directly involved in the funding and construction of Yujiapu.

If anywhere resembles Manhattan, it's actually Xiangluowan, another new business district being built just on the other side of the river. Many of the 'ghost city' news reports carried pictures from Xiangluowan alongside those of Yujiapu.

But while the fates of these two areas are closely tied, Xiangluowan is a 3.2 square-kilometer financial district in its own right. Among the zone's 48 planned buildings is the 91-story, 468-meter R&F Guangdong Tower which, upon completion, will be one of China's tallest structures.

"This place is almost empty, with only a few people," our taxi driver reflects as he escorts us across the river. "But in the last one or two years the process has become quicker. I think it will be finished next year."

It is clear that Xiangluowan is at a later stage of development than Yujiapu. Inside a showroom for a mixed-use development called the Binhai Center, apartments and commercial space are already available for RMB12,000-14,000 per square meter – in line with average prices in Tianjin. The salesman claims that by early 2018, the area will be busy and other facilities in the district will have opened.

His confidence is clearly an unreliable indicator. But a number of buildings on this side of the river are complete and open for trade, though many appear to be covered in a thin layer of dust. We find some small businesses, including a convenience store and an independent cafe. The owner of the latter tells us that she hopes to launch next month, though there is a nearby branch of coffee chain SPR to meet demand for now.

The new Xiangluowan CBD located just across the river from Yujiapu.

Perhaps most tellingly, a number of banks have opened their doors in the district. Their appearance marks the initial answer to the crucial question – how will these empty financial districts fill up?

As in all new city developments across China, the relocation of state-owned enterprises and public facilities is the first step in populating an area. These so-called 'anchor tenants' will always appear the earliest, explains Shepard.

"By the time [a new urban project] is ready, the local government flips a switch and the institutions that the state owns – like banks and universities – move in," he says. "That gets the ball rolling. It never really happens gradually, it's almost immediate. There's a tipping point that is very obvious.

"I remember a TV news crew wanting to take me to a 'ghost city' near Shanghai when I was promoting my book," he recalls. "I'd been there nine months before and the place was pretty desolate. But we went back and there were people everywhere, they'd opened up the high-tech zone, and the reporter was like: 'This just looks like normal.' But that's how fast these things can happen when the authorities are ready to flip the switch."

A number of private organizations have also expressed their intent to move to the area. The Tianjin branch of New York's prestigious arts conservatory, the Julliard School, aims to set up in Yujiapu by 2018. And, peering through the glass door of a finished building in Xiangluowan, we see signs announcing a makerspace by tech giant Tencent.

It is only after businesses and services move in that 'regular' people can be expected to follow. Low-price land and tax breaks can be used as an incentive to encourage them to relocate, explains Assistant Director at Tianjin University of Commerce's Institute of Urban Construction, Wang Wei.

"The local government has ways to get people to move there, not only by investing money, but also through policies," he says. "It can give people a hukou [household registration], for instance, which may encourage people from other provinces to relocate there for better education or healthcare."

In essence, writing off Tianjin's new financial districts as ghost cities is premature until this process is underway. And there are precedents from across China that provide a model for what success might look like.

After stuttering through development in the 1990s, Shanghai's Pudong district now has occupancy rates of more than 95 percent in its central area, Lujiazui. Meanwhile, the Zhengdong New District in Zhengzhou (which as recently as 2013 was presented in Western media as a 'ghost city') is now home to around 1.5 million people who must deal with one of the realities of life in a busy metropolis – traffic jams.

"Look at other similar large-scale CBD projects that got their start a little earlier – in the late 1990s and early 2000s," says Shepard. "If you use those as a model for what Yujiapu could become, then the future looks rather kinetic, if not bright."

Yet the problem for Yujiapu and its financiers is that the longer it remains empty, the more it costs.

Unfinished buidlings loom over an entrance to the shopping area.

"Someone must be taking the losses," explains Gillem Tulloch, founder of the financial analysis firm GMT Research. "You would assume the contractors are getting paid by the local government, which is not defaulting on its bills. But someone has to account for and operate the buildings, and it'll have to carry costs – depreciation and so on. If you're spending a lot of money maintaining empty buildings, then it means less money on other stuff."

Many of the recent 'ghost city' reports have focused on the falling revenue of Yujiapu's main financiers, Tianjin Binhai New Area Construction & Investment Group Co. But this state-backed vehicle appears to have the ability to absorb short-term losses. The international ratings agency Fitch Ratings recently afforded it an A- rating due to a "strong likelihood of extraordinary support" from Tianjin's municipal authorities.

In other words, the project may be too big to fail.

To understand its political and economic importance, Yujiapu should not be viewed in isolation. Instead, it is more helpful to consider the mosaic of developments taking place across the region. North of the district you find the Sino-Singapore Eco City, and to the east you find the Tianjin Economic-Technological Development Area (TEDA), which is home to more businesses than all of Shanghai.

Zoom out and you see that Yujiapu is just one part of an economic restructuring that aims to see the Binhai region rival other 'special economic zones' like Shenzhen. Zoom out again and you see the Beijing-Tianjin-Hebei megacity project (Jing-Jin-Ji) that hopes to relocate millions of people from the overcrowded capital. Zoom out once more and you see a country that must accommodate for 250 million new urban residents over the next 10 years.

This by no means guarantees that every new urban development will become a bustling metropolis. A number of the ghost cities reported in the media will fail to attract the requisite interest, as their planners have miscalculated demand. There is also little doubt that a slump in the property market could seriously hinder Yujiapu's ability to lure new residents and businesses.

But it is far better placed than many of its counterparts. Tianjin's economic growth is still above the national average, and few developments have as much financial and political backing. If any of China's new city districts are to really succeed, one as strategically vital as Yujiapu would seem a likely bet.

We may not find out until the turn of the decade. So until then, a punt from Tianjin University of Commerce's Wang Wei is the best we can offer: "Maybe it will be a success, maybe it will be a ghost town, maybe it will just be a normal commercial center," he says. "But if I had money, I would buy property there."

Images by Holly Li

0 User Comments