Max Greb, a Shanghai-based portfolio manager at Olivar & Greb Capital Management, has extensive experience in professional investment and wealth management consulting for individuals and families. When time permits, he shares his insight in this column for That’s to highlight key sectors, market movements, or trade ideas to consider for your portfolio.

Max Greb, a Shanghai-based portfolio manager at Olivar & Greb Capital Management, has extensive experience in professional investment and wealth management consulting for individuals and families. When time permits, he shares his insight in this column for That’s to highlight key sectors, market movements, or trade ideas to consider for your portfolio.

This week’s column is all about silver. Precious metals often act as a hedge against the stock market and are integral components to a balanced portfolio. In today’s uncertain world, finding ways to minimize risk is even more critical, and the main reason these metals are drawing more attention.

Gold Gains

The price of gold has seen a dramatic 37% year-over-year increase, reaching USD1,750 per ounce, at the time of writing. Meanwhile, Bank of America (BOA) just increased their 18-month price target to USD3,000 per ounce, a 70% gain from here. “As economic output contracts sharply, fiscal outlays surge and central balance sheets double, fiat currencies could come under pressure,” according to BOA, which adds, “Investors will aim for gold.” With economies facing enormous challenges, this is a plausible scenario.

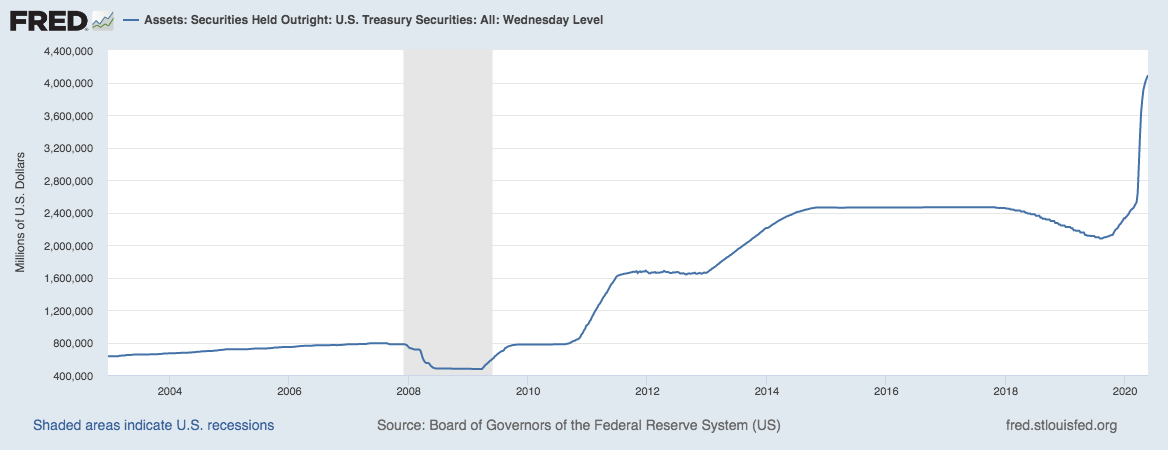

Federal Reserve Balance Sheet

Since the 2008 recession, the US Federal Reserve’s balance sheet has grown 1,000% (!) to USD4 trillion. Image via Federal Reserve Bank of St. Louis

Since the 2008 recession, the US Federal Reserve’s balance sheet has grown 1,000% (!) to USD4 trillion. Image via Federal Reserve Bank of St. Louis

Silver Lining

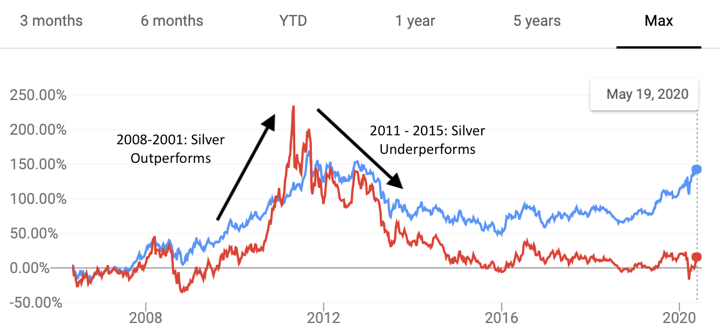

Referred to as the ‘poor man’s gold,’ silver is generally levered to the price of gold. When gold goes up silver outperforms, and when gold goes down silver underperforms. In the graph below, notice how silver (red) drastically outperformed from 2008 to 2015 when both rose, and loss significantly more than gold (blue) from 2011-2015 when they both declined.

Gold vs. Silver Pricing

Image via Google Finance

Image via Google Finance

Given this relationship, we would expect silver to have gained momentum over the past couple years while gold has accelerated. Instead, its price has stagnated and appears undervalued.

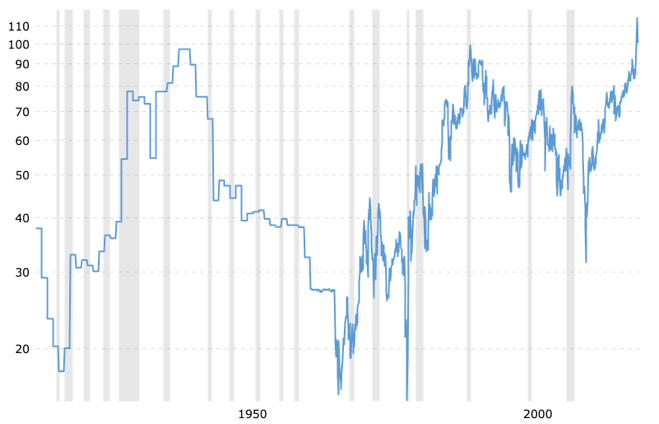

The gold/silver ratio confirms this assumption. (gold/silver ratio: the amount of silver it takes to purchase one ounce of gold.)

According to the gold/silver ratio chart below, silver is trading at its cheapest price in relation to gold in over 100 years. An investor would need 100 ounces of silver to buy 1 ounce of gold.

Gold/Silver Ratio

Image via Macrotrends.net

Simply Stated

The pandemic has caused significant disruptions. The deflationary pressures of a frozen global economy are being combated by a newly printed money supply that has flooded the market. It’s difficult to measure if this monetary policy will be enough to support the economic fallout, so caution is warranted. Given the amount of money printing and the above-mentioned technical indicators, precious metals offer distinct diversification and hedging capabilities throughout this time period.

Final Notes

Commodity trading is not suitable for all investors; silver in particular is highly volatile. In the first three months of 2020, silver was down 35%. Position sizing is critical. Here’s how we gain exposure to the metals:

Silver: iShares Silver Trust (NYSE: SLV)

Gold: SPDR Gold Trust (NYSE: GLD)

Precious Metal Miners: (NYSE: GDX/GDXJ)

To learn more, please reach out to Max with questions, comments and requests at max.greb@olivar-greb.com.

Disclosures

The content in the article is O&G’s own opinion. O&G clients and our team may hold positions in the securities mentioned in this article. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. The opinions expressed in this report do not constitute a buy or sell recommendation. Please note that performance comparisons are based on historical data, are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Past performance is no guaranty of future returns.

[Cover image via Pixabay]

0 User Comments